are union dues tax deductible in 2020

Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and theres a state deduction for your union. Tax reform eliminated the deduction for union dues for tax years 2018-2025.

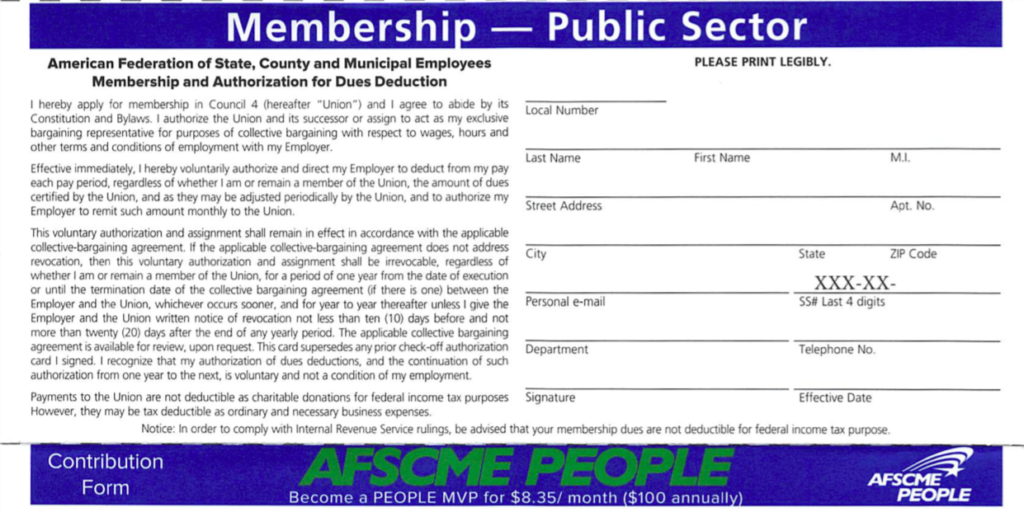

Union Membership Cards Raise Legal Questions Following Janus Yankee Institute

You can still claim certain expenses as.

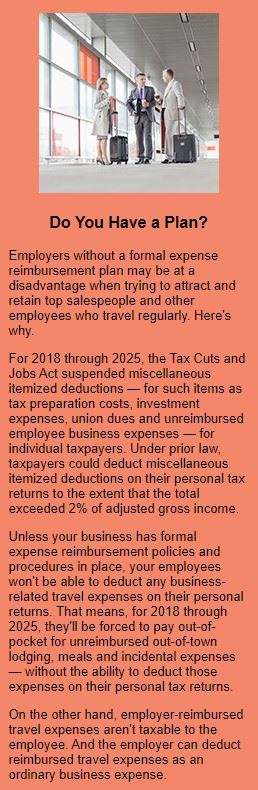

. Tax reform changed the rules of union due deductions. Union Dues or Professional Membership Dues You Cannot. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize.

An employee business expense is generally defined as an expense paid by the employee for the purpose of carrying on a job with their employer or a business. For tax years 2018 through 2025 union dues and all employee expenses are no longer. Employee business expenses are currently not tax-deductible under current federal law as the ability to deduct these expenses has been suspended starting in 2018 and running until 2025.

Are union dues tax deductible in 2020. They along with other miscellaneous job-related expenses like. This is in response to an email we received from Craig Mutter on November 23 2020 and our discussion of January 14 2021.

Are union dues tax deductible 2020. Claim the total of the following amounts that you paid or that were paid for you and reported as income in the year related to your. Can I deduct my union dues in 2020.

Its confusing because in prior years union dues and expenses were deductible on Schedule A. Union dues are no longer tax deductible. Deduction of union dues.

Miscellaneous itemized deductions are those deductions that would have been subject to the 2-of-adjusted-gross-income AGI limitation. For tax years 2018 through 2025 union dues are no longer deductible on your federal income tax return even if itemized deductions are taken. If you are an employee you can claim your union dues as a job-related expense if you itemize deductions.

You can claim a. Most unions and associations send their members a statement of the fees or subscriptions they pay. The states official tax instruction book confirms union dues can still be deducted from state taxes subject to itemizing and if your miscellaneous deductions exceed two percent of your.

This publication explains that you can no longer claim any miscellaneous itemized deductions unless you fall. Job-related expenses arent fully. However most employees can.

SOLVED by TurboTax 8016 Updated December 22 2021. If youre self-employed you can deduct union dues as a business expense. Are union dues tax deductible 2020.

June 3 2019 1127 AM. Tax reform changed the rules of union due deductions. For tax years 2018 through 2025 union dues and all employee expenses are.

The answer to your question is that the deduction for union dues and all employee expenses has been eliminated for tax years 2018 through 2025 regardless of whether an. Line 21200 was line 212 before tax year 2019. Claiming union dues twice can result in a notice of reassessment and a possible penalty tax and interest owing.

A reminder for tax season. Social security contributions up to the prescribed amount of maximum mandatory contributions and union dues paid by employees are not included in gross income and are exempt from.

Tax Receipts For The 2019 20 Financial Year Have Now Been Sent If You Have Not Received Your 2019 20 Tax Receipt Via Email And Don T Receive It In The Post In The Next

Frequently Overlooked Tax Deductions For 2020 Bottom Line Inc

Deducting Union Dues H R Block

Tax Tips Every Nurse Should Know Joyce University

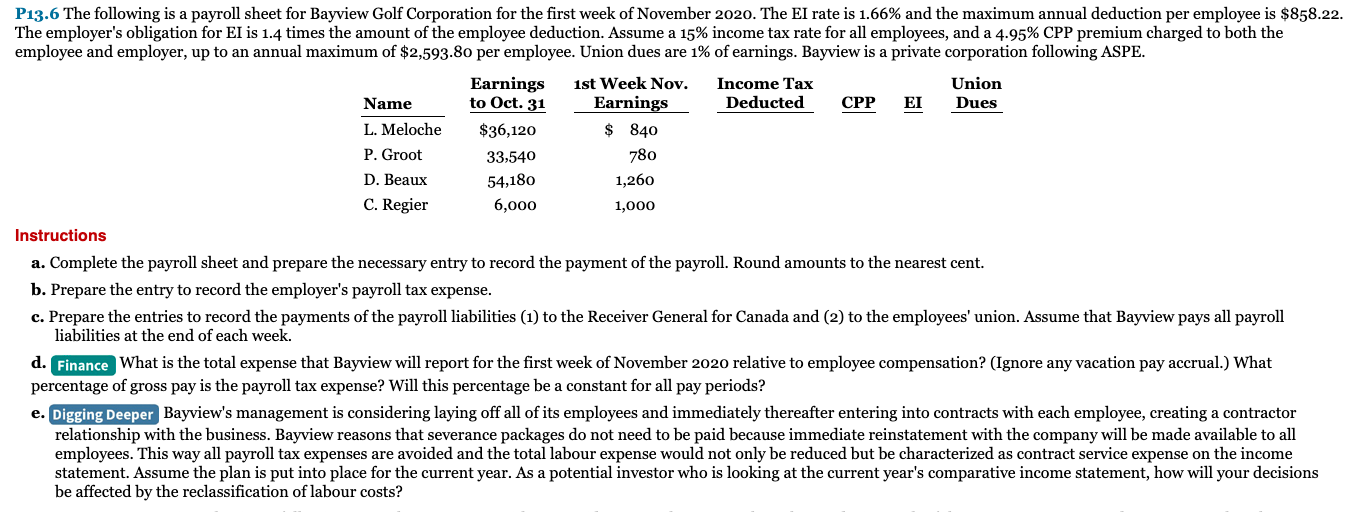

P13 6 The Following Is A Payroll Sheet For Bayview Chegg Com

Pipsc Union Dues Tax Deductible R Canadapublicservants

Union Dues Are Now Tax Deductible Foa Law

How To File Your Taxes And Tax Tips For Part Time Workers

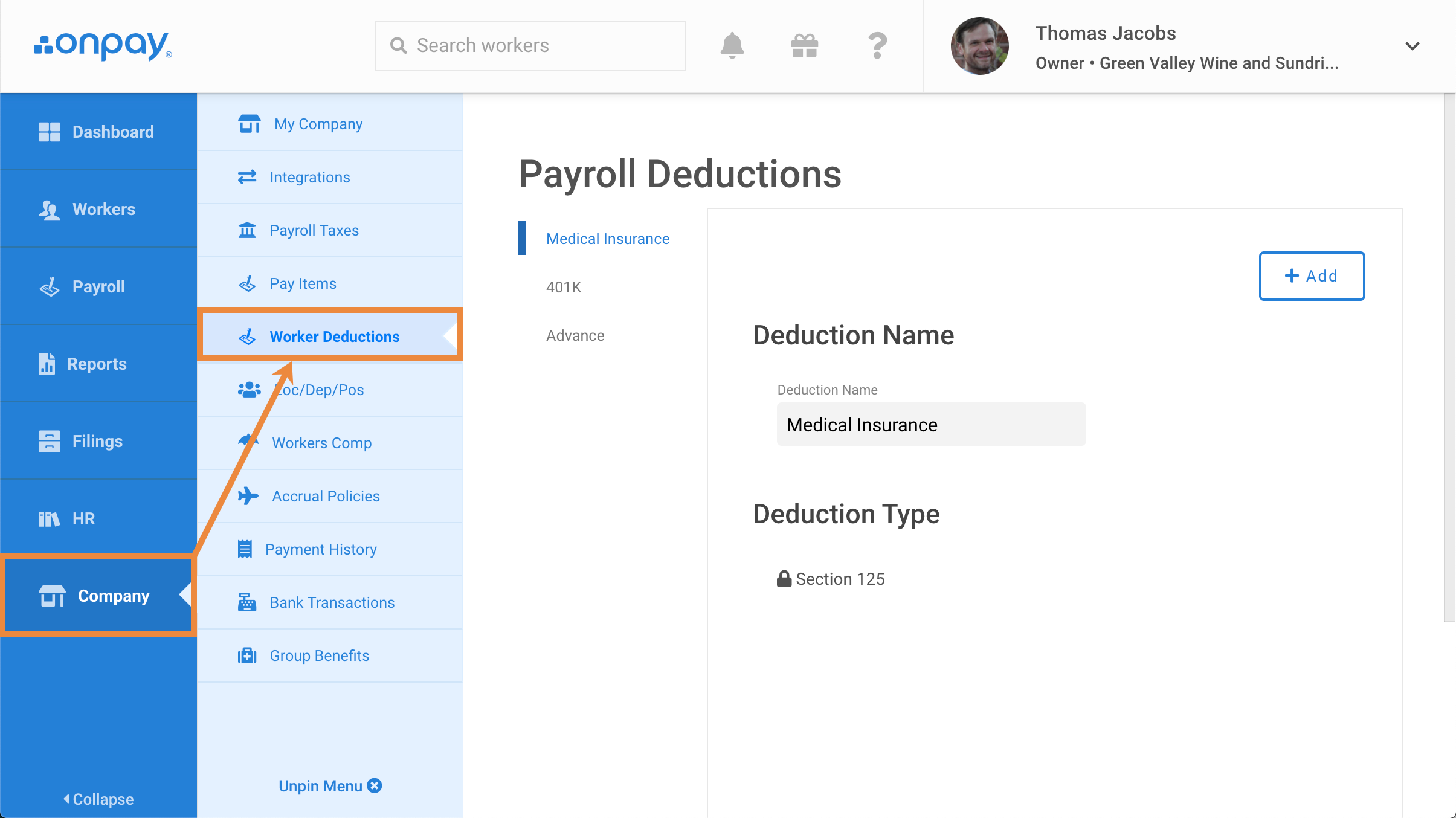

How To Create And Add Payroll Deductions To Employees Help Center Home

What Are Payroll Deductions Article

Dues Check Off Provisions Once Again Expire With Cba Nlrb Rules Barnes Thornburg

Taxes For Actors 2020 Deductions Deadlines More Backstage

Nlrb Requires Employers To Maintain Union Dues Deductions

A Tax Break For Union Dues Wsj

Don T Miss Out On Money When You File Your Taxes Yaktrinews Com

Membership Application Msu Denver Faculty Federation

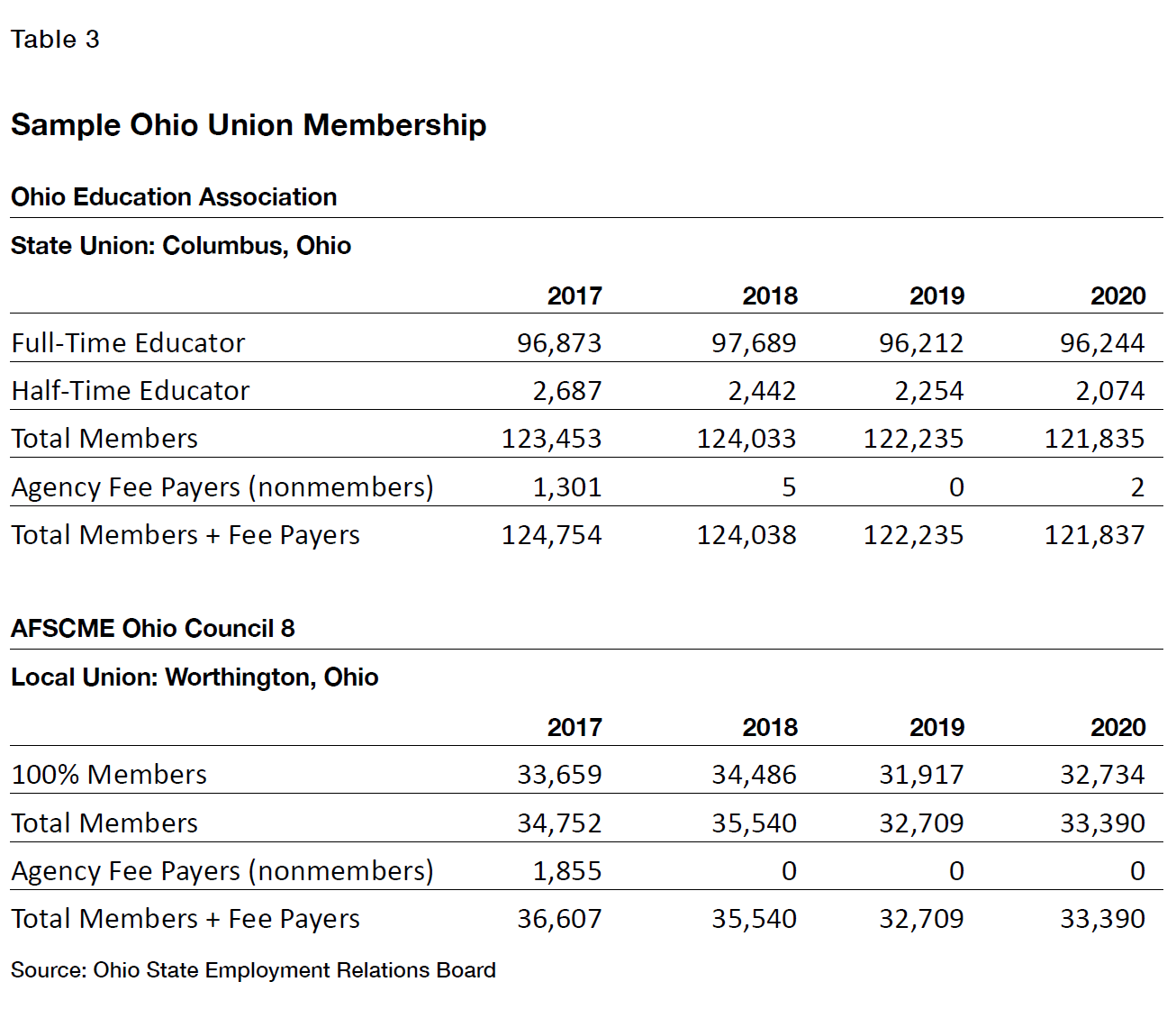

By The Numbers Public Unions Money And Members Since Janus V Afscme Manhattan Institute

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Union Dues No Longer Deductible Under New Tax Law Don T Mess With Taxes